Analysis: Average-priced Missoula homes seeing massive property tax increases

Missoula has been spending at rates dramatically in excess of population growth plus inflation – causing property taxes to spike.

Most Missoula property owners will be quick to tell you their property taxes are rising at alarming rates. Unlike some other cities and counties in Montana, Missoula does not make the exact amount of revenue they receive from property taxes easily accessible, making it difficult to calculate how much property taxes have increased for the entire city.

But one way to get a snapshot of how much property tax increases is by looking at how much tax bills have increased for specific homes.

To do this data was used from Zillow based on public records to find homes that are valued within two thousand dollars of the median home price in Missoula of $420,000, according to 2021. Zillow estimates home prices by factoring “public property records, tax records, recent home sales in the area, and user-submitted information to come up with an approximate market value for a home.” This estimate is just that – an estimate, but it does give us a basis to compare tax increases across the city.

According to Zillow the home pictured below has an estimated worth of $420,000. In 2007, this home had a tax bill of $1,789.27. The same home had a 2021 tax bill of $3,654.18 – a 104.2% increase and an average year-over-year tax increase of 7.4%.

According to a legislative report, Montana’s state average for property tax increase in a year is 5%, meaning that the owners of this home annually saw a 2.4 percentage point increase over the state average.

The next home’s estimated worth is $420,800. In 2007, this home had a tax bill of $1,575.66, and by 2021 its bill had risen to $3,357.37. That is an increase of 113%, or an average yearly increase of 8%. They paid 3 percentage points more than the state average.

Zillow estimates that the home below is worth $421,700. In 2007, they had a tax bill of $2,130.96. By 2021 their bill increased 90.3% to $4,054.39. These homeowners saw a 6.5% year over year increase, which is 1.5 percentage points higher than Montana’s yearly average.

Missoula’s problems are even worse when compared to property tax increases nationally, which increased at an average rate of 3.2% between 2016 and 2020. That’s more than double the rate of the house with the smallest increase in our analysis, house three. In fact, if you took that home’s property taxes in 2016 and applied the national average property tax increase rate from 2016 to 2020, that homeowners bill would have $451 less in 2020.

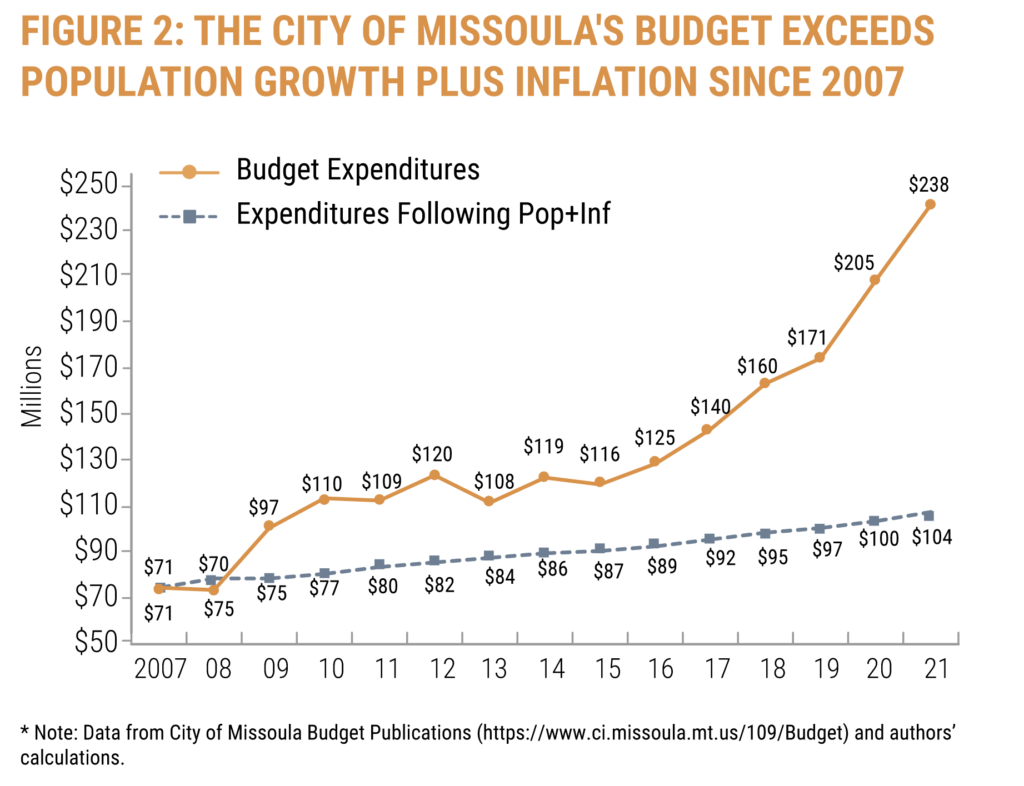

So, why is this happening? It’s pretty obvious when you look at how the city government is spending money. As shown in the Frontier Institute report The Real Missoula Budget: The State of Missoula’s Spending the city has been spending at rates dramatically in excess of population growth plus inflation, a widely accepted benchmark for responsible government spending increases.

If lawmakers had stuck to that rate of increase since 2008, the city’s spending would be less than half of what it is today.

When spending grows at such dramatic rates, local governments have to raise additional revenues, resulting in a higher tax burden. This would be even more clear if the city budgeting process was more transparent, and it was easily identifiable how much revenue the city collects from property taxes year over year.

As property tax due dates quickly approach, Missoulians should be looking for ways to limit the growth of already expensive property taxes. Without restrictions on the growth of spending Missoula will continue to spend outside its means, forcing taxpayers to foot the bill.