Keep Taxes Low

The growth of property taxes is no doubt a huge concern to many of our followers across the state, with good reason.

The growth of property taxes is no doubt a huge concern to many of our followers across the state, with good reason. As the main revenue source for local governments, property taxes serve as a painful representation of the ever-expanding footprint of government in our communities.

But if you ask local governments, current property taxes aren’t enough. It seems every year, cities and counties are asking taxpayers for more – and voters are giving it to them. Just this week, the Chronicle reported that Bozeman is looking at yet another property tax increase, saying more taxes are needed to “sustain the city.”

Part of the reason why voters are so susceptible to indulging local government’s requests for more taxes is the lack of information available to voters about the growth of local governments.

Trends matter. A $100 tax increase to fund a project doesn’t seem so bad taken on its own. Proponents often describe the increase as “only costing taxpayers a cup of coffee each month.” But lots of small increases added up over time can lead to thousands of dollars in additional tax burden.

Without the proper context about the growth of local governments, voters simply cannot make informed decisions about whether their government is spending and taxing within the means of its taxpayers.

Requiring transparency about the growth of local governments would be a good step towards getting property taxes under control.

That’s why we’ve endorsed Senate Bill 212. This proposed law would require local governments to put their growth up against a measuring stick for fiscal responsibility when asking for new property taxes, empowering voters to ensure government spends taxpayer dollars responsibly.

This bill was stalled in the House Taxation Committee until today. Now it heads to the House floor, but we still need your help.

We’ve started a petition to encourage lawmakers to get SB 212 passed. Please take a moment to tell your representative to pass SB 212 and help voters keep taxes low.

For Liberty,

Kendall Cotton

. . .

Conservative Montana Budget

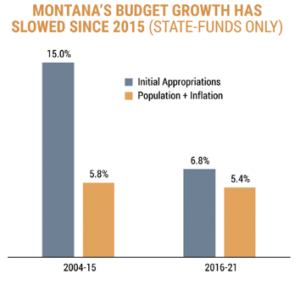

- Speaking of trends, I’ve been asked several times how the legislature is doing at limiting the growth of spending. Right now, the legislative fiscal division marks a 3.6% increase in state spending under HB 2, the main budget bill. How does that compare to earlier sessions? Take a look at this analysis from our Montana Recovery Agenda:

Our Take:

Compared to average growth of state appropriations over the last 16 years, 3.6% is a significant decrease in spending growth. If the legislature can keep this going, we will be taking a big step towards correcting years of uncontrolled spending growth.

PBM’s

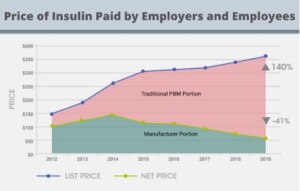

- Senator Greg Hertz introduced SB 395 this week, which requires transparency from little-known pharmacy middlemen called Pharmacy Benefit Managers (PBM’s). If you want to gain a quick understanding about how PBM’s impact the cost of your prescriptions, take a look at this graph:

Our Take:

Pharmaceuticals are one of the main cost drivers of healthcare, and the secretive practices of PBM’s play no small part. Transparency is badly needed to ensure that patients benefit from negotiated discounts and that PBM practices are not contributing to the growth in pharmaceutical prices. Click here to view a great breakdown on this issue from our friends at the Texas Public Policy Foundation.

ICYMI

- Catch my latest op-ed in Lee Newspapers, reminiscing about the Montana values and “radical openness” of country music legend Charley Pride.