Viewpoint: The Losses to Physician Medicare Reimbursement in 2022/23 are Mind-boggling. Update to “When Will Enough Be Enough.”

"Inflation acts like a hidden tax which erodes the buying power of people’s income and savings and eats away at the ability to achieve long-term financial goals."

This article is a part 2 update to “WHEN WILL ENOUGH BE ENOUGH? WHY PHYSICIANS ARE QUITTING MEDICARE”

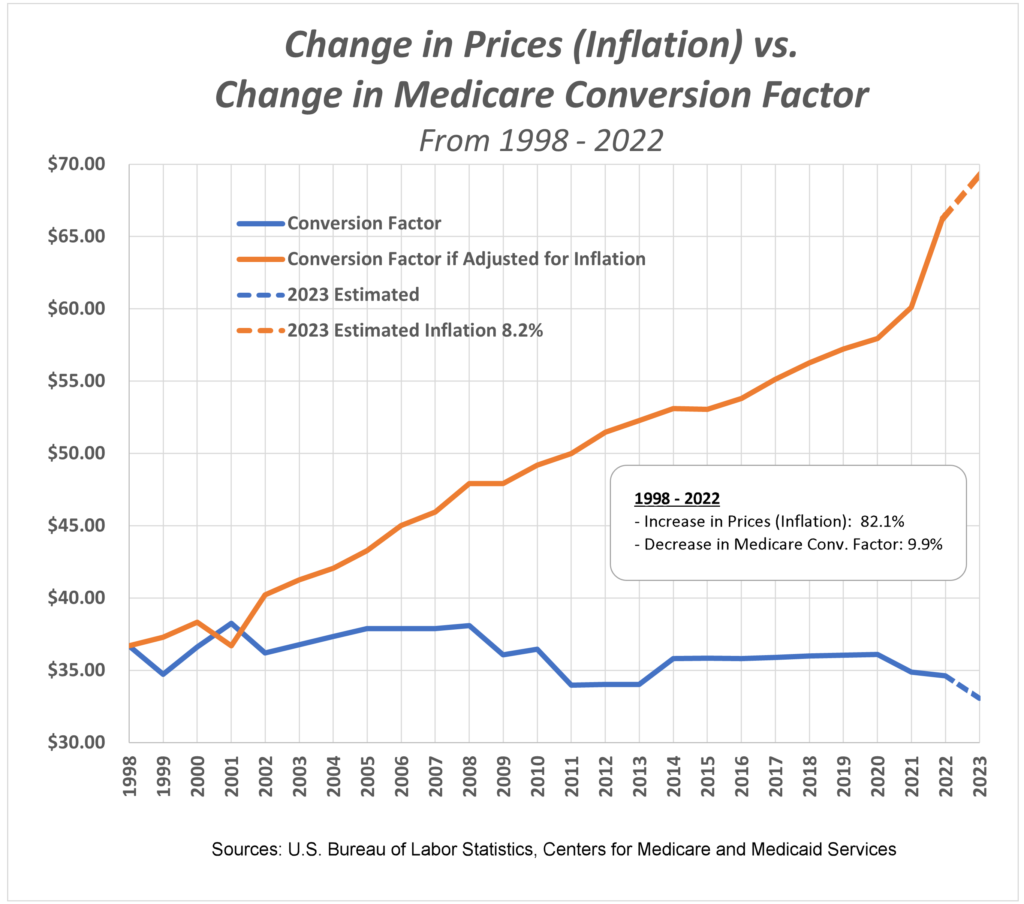

In the past few months, we (Kathleen Brown MD and I) have received numerous inquiries from physicians seeking guidance on quitting Medicare and starting a direct pay medical practice. In part, this is due to the recent abrupt worsening of the unsustainable reduction in Medicare reimbursements and inflation. I decided to update my article from March 2022 by recalculating the “Change in Prices (Inflation) vs. Change in Medicare Conversion Factor“ graph. The results are disturbing.

About this graph: Inflation

Inflation acts like a hidden tax which erodes the buying power of people’s income and savings and eats away at the ability to achieve long-term financial goals. It happens when the supply of currency increases faster than the supply of goods and services. When more currency is available, each unit of currency is worth less. The average inflation rate is a measure of how much value the currency has lost in a given year, which means you need more money to buy the same goods and services. This graph assumes inflation to continue at 8.2% for 2023 (dotted orange line).

- In 1998, the inflation rate was 1.56%. Between 1998 and 2022, the average annual inflation rate was 2.53%. As of October 2022, the inflation is 8.20%.

- There are different measures of inflation. In this example we are using the consumer price index (CPI). Had we used the inflation rate for medical care, the results would have been much worse. This is because over the past 30 years (up to 2021), healthcare costs, including medical services, insurance, prescription drugs and medical equipment, have mostly risen faster than the CPI.

About this Graph: Medicare Conversion Factor

- Since 1992, physician payments under Medicare are determined by a complex formula, and have been tied to the Medicare Conversion Factor. This is a major factor determining the amount of money doctors get paid per RVU (relative value unit), although there are some other ways doctors can get a tiny bit more (such as MIPS) by jumping through bureaucratic hoops.

- From 1998 – 2022 the Medicare Conversion Factor has decreased by 9.9%.

- Due to the impact of 24 years of inflation, physicians have seen prices of goods and services increase by 82.1%.

- On November 01, 2022, the CMS finalized a 4.48% physician pay cut to the Medicare Conversion Factor for 2023 caused by statutory-mandated cuts. This cut will take effect January 1, 2023, and is represented by the blue dotted portion of the conversion factor line.

- 90% of medical practices reported that the projected reduction to 2023 Medicare payment would reduce access to care for Medicare beneficiaries.

Pay-As-You-Go:

- PAY GO, which stands for “pay as you go,” is a budget rule requiring that tax cuts and mandatory spending increases must be offset (i.e., “paid for”) by tax increases or cuts in mandatory spending.

- The Congressional Budget Office has estimated that a Statutory PAYGO sequester in fiscal year 2022 resulting from passage of the American Rescue Plan Act of 2021, and the $1.9 trillion COVID-19 relief package passed in March 2022, will cause a 4% reduction in Medicare spending – or cuts of approximately $36 billion.

- NOT shown on this chart is a 4% physician pay reduction due to the statutory Pay-As-You-Go rule.

- Congress always has acted to prevent a Statutory PAY GO sequester in years when legislation has been enacted that increases the deficit. However, since 2022’s inflation is the highest since 1941, a last minute Congressional reprieve has not been given. Further, if the next Congress decides to kick the PAY GO ball down the road, there will be significant claims processing implications for retroactively applying these policies for Medicare.

- If 2023 inflation persists at its current rate (assumed on this graph), physicians will see their purchasing power erode by an additional 8.2%.

What does that mean for physicians?

Inflation: Generally, when the cost of goods and services increases due to inflation, the average worker’s wage increases as well. However, people with fixed incomes, such as retirees living off Social Security, must rely on government adjustments to entitlement payments or they become poorer. In most instances, the government automatically adjusts for the impact of inflation. For example, the IRS tax inflation adjustments for 2023 made adjustments to more than 60 tax provisions due to rising inflation.

While the IRS automatically adjusts income tax brackets and the standard deduction every year in response to annual inflation, it does NOT make routine inflation adjustments to Medicare reimbursements for physicians. Since 1992, physician reimbursement under Medicare has been tied to the Medicare Conversion Factor. Unfortunately, unlike the IRS tax inflation adjustments example, Medicare payments to physicians have not adjusted for inflation since 1998, and have actually decreased 9.9%.

However, Medicare adjusts payment to hospitals, skilled nursing facilities, home health agencies, hospices and other entities for the services they provide based on “market baskets and Medical Economic Index.” So, as inflation rises, so too do the base payments for Medicare-covered services. However, Medicare physician reimbursements DO NOT adjust for these “market baskets.” Medicare has severed physicians from this inflation adjustment.

In the graph, we can see the effect of inflation compared to the change in the Medicare Conversion Factor since 1998. While Medicare Conversion Factor has slightly DECREASED from 1998 to 2022, the cost of living and the cost of running a medical practice have increased dramatically due to inflation.

Medicare conversion factor and Pay Go: Another reason physicians are now leaving Medicare is because payments to physicians have decreased in the past 21 years (in 1998 the Medicare conversion factor was $36.69. In 2022 the Medicare conversion factor was $33.06). At the same time, inflation has decreased the value of those payments.

Looking to the future, a 4% PAY GO sequester cut, combined with the 4.5% pay cut from the Medicare conversion factor, may result in nearly an 8.5% cut in physician reimbursement. Imagine trying to run your business when your Medicare reimbursement may decrease by 8.5%. This is compounded by the fact that costs will continue to rise by at least the rate of inflation which is currently 8.2%. What do you tell your employees? What do you tell your Medicare patients?

Conclusion:

Physicians now face a stark choice. Economically, Medicare reimbursements may no longer be viable. Physicians are facing:

- 9.9% pay reduction in the Medicare conversion factor (1998 – 2022)

- 4.5% Medicare conversion factor cut in 2023

- 4% Pay Go cut for 2023

- 82.1% increase in the price of goods and services over 24 years due to inflation.

These cuts will also significantly reduce physician payments, restrict access to care, and further jeopardize quality of patient care. These economic reasons combined with an increasingly bureaucratic regulatory nightmare, compromises in care, RAC audits, cause some to realize that their solution is not to fix Medicare, but to leave Medicare. Quitting Medicare and moving to a Direct Pay or DPC medical practice is one way a physician can accomplish this.