Viewpoint: When Will Enough be Enough? Why Physicians are Quitting Medicare

"Physicians find themselves faced with an increasingly bureaucratic regulatory nightmare, forcing them to choose between providing good medical care or playing the 'Medicare game' to survive."

In 2010, my wife was a physician in a small multi-specialty medical group, practicing general medical/surgical dermatology. After 16 years of practicing medicine, economic, legal and bureaucratic conditions were so out of control she decided she could no longer practice medicine properly and continue to accept Medicare. So, like over 25,800 other medical professionals, she decided to no longer participate in Medicare by opting out and quitting all other third party payer arrangements.

In addition to opting out, physicians are reducing their dependence on Medicare in other ways. Some physicians who accept Medicare are not accepting new Medicare patients. The Kaiser Family Foundation found that 28% of primary care physicians who accept Medicare will not accept new Medicare patients. Importantly, the way medical care is provided to Medicare beneficiaries has changed, and not for the better.

As the rules involving medical records, billing codes and prior authorizations become unsustainable, some demoralized physicians are escaping by closing their independent practices and joining large hospital networks. Physicians on average now spend 27% of their time in their offices seeing patients and 49.2% of their time doing paperwork, which includes using the electronic health record (EHR) system. For many physicians, leaving Medicare or leaving private practice has become a matter of survival.

So, What’s Going On?

Doctors are being squeezed

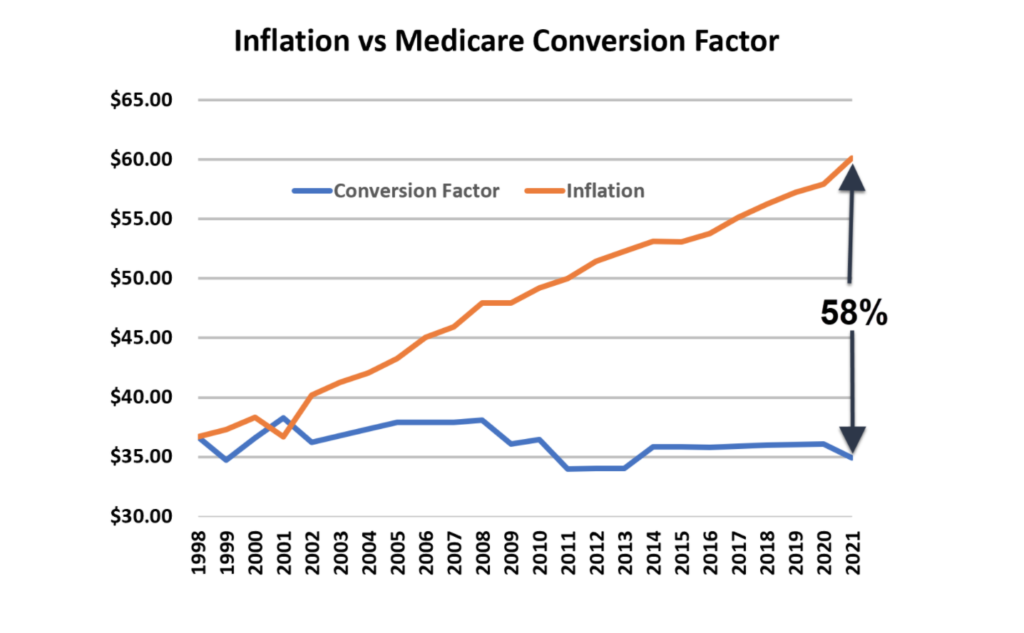

Since 1998, physician payments under Medicare are tied to the Medicare Conversion Factor. This factor determines the amount of money doctors get paid per RVU (relative value unit). What is squeezing physicians is that Medicare payments to physicians have not increased in the past 21 years. In 1998 the RVU was $36.69. In 2022, the RVU was $34.89. However, the cost of living and the cost of running a medical practice have increased dramatically. According to the U.S. Bureau of Labor Statistics, consumers paid a lot more for goods and services in 2022 than in 1998. Food prices have increased 80.34%, medical care prices have increased 120.97%, and energy prices increased 153.36%. So, even though payments to physicians have not increased in 21 years, when adjusted for inflation, Medicare payments to physicians have effectively DECREASED by 42%. It is also important to realize that 42% is based on general CPI inflation numbers. Had we used the medical inflation numbers, it would have been even higher (medical care inflation has grown at an average annual rate of 5.3% while the CPI has grown at an average annual rate of 3.5%).

Click here to see the updated 2022/23 numbers.

It’s Not Just Inflation

Inflation’s erosion of the Medicare conversion factor (RVU) is just one hit to physician compensation. Practicing medicine has become increasingly expensive due to medical advances, legal liability, new treatments, the cost to implement and maintain electronic health data, ever increasing regulations and growing patient demand for services. Physicians are faced with growing administrative burdens, such as prior authorization requirements, which demand an exorbitant amount of time and resources to process. Like inflation, these factors impact the medical practice bottom line and create an incentive to increase volume rather than focus on the quality and value of care. To further complicate physicians’ financial pressures, the Medicare population is growing as baby boomers reach retirement age. Physicians who have been in practice for a while are experiencing increases in their Medicare patient population, even if they have stopped taking new Medicare patients.

Unfortunately, under the current Medicare system, there is little hope for improvement in the future. The general attitude maintains that doctors are wealthy and will stick around to treat patients even if they’re paid Medicare rates for all patients. Dean Baker, senior economist at the Center for Economic and Policy Research, summed it up when he said, “The idea that doctors won’t work for Medicare pay is nonsense. What will they do, sell shoes instead?”

For those who believe all physicians are wealthy, that is simply not true. According to the Association of American Medical Colleges (AAMC), the median medical student accrues about $75,000 – $150,000 of debt for every year of medical school. By the time they graduate, they’re 28 years old with approximately $200,000 – $500,000 of student loan debt. Then they go to residency, which is anywhere from three to seven additional years of training where the average salary is $63,400. After accounting for tax, food, housing and other living expenses, that doesn’t leave much for student loan repayment. A total of 19.5% of physicians take a full 30 years to pay down their medical school debt.

The Medicare Payment Advisory Commission recommended a 0% physician pay update for 2023 and the Medicare Board of Trustees continues to keep the focus on overall projected growth in Medicare spending rather than on ensuring continued access to physicians.

Physicians are facing a continuing statutory freeze in annual Medicare physician payments that are scheduled to last until 2026. After that, payment updates will resume, but only at a rate of 0.25% a year indefinitely. Perennial struggles to stop automatic cuts in Medicare provider payments have grown old. A medical practice cannot plan for the future if they can’t have some reasonable prediction of their income. Medical practices that rely on Medicare cannot realize financial security.

“Sometimes it seems as if there are more solutions than problems. On closer scrutiny, it turns out that many of today’s problems are a result of yesterday’s solutions.” – Thomas Sowell

To continue seeing Medicare patients while remaining solvent, physicians are forced to do more with fewer resources. Physicians find themselves faced with an increasingly bureaucratic regulatory nightmare, forcing them to choose between providing good medical care or playing the “Medicare game” to survive. Over the past 57 years, layers of “solutions” have been imposed by government mandates and burdensome administrative requirements, making Medicare unsustainable for many physicians.

Audits

It is dangerous to accept Medicare. Recovery Audit Contractors, (RAC) audits, also known as Medicare Audits, are ongoing, aggressive, intrusive programs with the sole purpose of recovering money from physicians. Medicare hires outside contractors or “bounty hunters” to provide these audits. RAC contractors receive a 9.2% to 12.5% commission on each successful RAC denial (a “clawback”). RAC audits are expected to become more frequent for the foreseeable future. RAC audits pose a serious threat to physician practices, finances and reputation. RAC audits are federally designed to take back Medicare reimbursement from physicians.

Conclusion

The question now becomes why would physicians stay in Medicare, when it is awful for them and also often harms medical care? One reason is their employer requires it, and then their employer makes the decisions on compromises to be made and games to be played. Another is that most physicians really do care about their patients and their access to medical care, and there is strong social and societal pressure to stay in it. However, if compromises in care are occurring, (and they are), the patients also deserve other choices, and physicians who leave Medicare can provide them.

Healthcare Viewpoints is a monthly series featuring original columns from Montana healthcare leaders focused on addressing the challenges presented by our broken healthcare system. The opinions of guest authors do not necessarily represent the policy positions of the Frontier Institute.