Want Tax Relief? Reject Reckless Spending

"Rather than trying to get ‘just a little more’ from taxpayers, local governments need to follow Montanans’ lead and cut excess spending."

From Anaconda to Miles City, Montanans are feeling the impact of rising property taxes. One reason for skyrocketing property taxes is that local governments spending has outpaced the growth of the economy.

When government spends more, they look to you and I to cover the difference – even if our ability to pay isn’t keeping up.

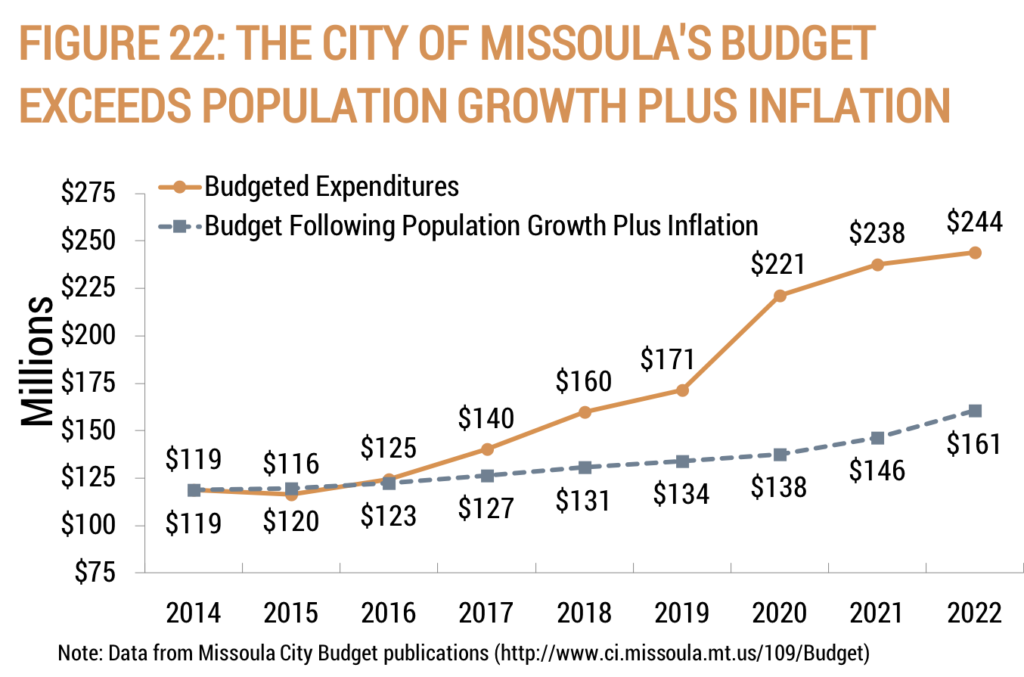

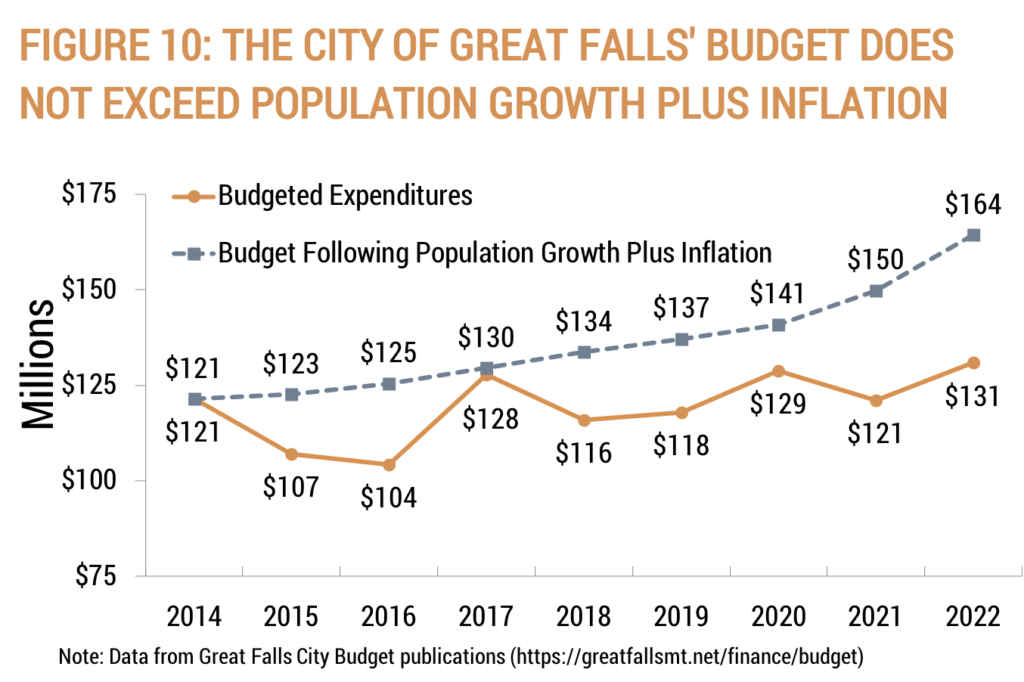

Take for example Missoula’s spending which has drastically outpaced the growth of the economy as measured by population growth plus inflation, while Great Falls’ spending has not.

With the knowledge that spending drives taxes, there is a new proposal to address reckless spending by local governments in Montana.

Representative Caleb Hinkle has introduced HB 324, a bill that would cap local government spending increases to the growth of the economy, as measured by population growth plus inflation. This follows the recommendations we laid out in our 2023 Local Budgets Report.

While testifying in support of this reform, Frontier Institute President & CEO had this to say:

“While Montanans are tightening their belts amid skyrocketing property taxes, inflation and increased cost of living, many of our local governments are continuing a spending spree. HB 324 will help keep the cost of government within the bounds of what average taxpayers can reasonably afford and make room for property tax relief.”

He’s exactly right, inflation and a slow economy is affecting us all, rather than trying to get ‘just a little more’ from taxpayers, local governments need to follow Montanans’ lead and cut excess spending.

For Liberty,

Tanner Avery

The Latest

MTLeg Weekly Debrief: February 6-10

SB 245 follows Frontier Institute’s recommendation to give landowners in Montana cities more freedom to build denser starter homes to address the housing crisis. Click here to learn more.

SB 273 allows state medical savings accounts to be used to pay for Direct Primary Care (DPC) memberships, classifying DPC as an eligible expense. Click here to learn more.

HB 393 follows Frontier Institute recommendations to expand education options for Montana parents and students by creating Montana’s first Education Savings Account program. Click here to learn more.

HB 408 follows Frontier Institute’s recommendations to expand education options for Montana students by increasing the student tax credit scholarship funding cap. Click here to learn more.

HB 409 requires Montana to automatically recognize a license for advanced practice registered nurses from another state in the Advanced Practice Nurse Interstate Compact. Frontier Institute has recommended that the legislature go even farther, making the pandemic model of universal licensure recognition permanent. Click here to learn more.

The Latest In Energy Abundance

Last week, Allete and Grid United announced a massive $2.5 billion project to build 385 miles of high voltage direct current transmission lines from central North Dakota to Colstrip. The North Plains Connector would allow power to flow to and from the Midwest to Pacific northwest. The project may reduce the risks of power outages during extreme weather events, reduce energy costs and increase the market for energy produced in Montana.

Our Take: The North Plains Connector project furthers the goals we laid out in our 2022 Energy Strategy. This project will enhance Montana’s export capacity to new markets in the midwest while states like Washington and Oregon transition from coal. This new project will also allow Montana renewable energy projects to integrate more easily into the grid, making it easier to export to markets in the northwest. This project is another positive step toward making Montana an energy abundant state.

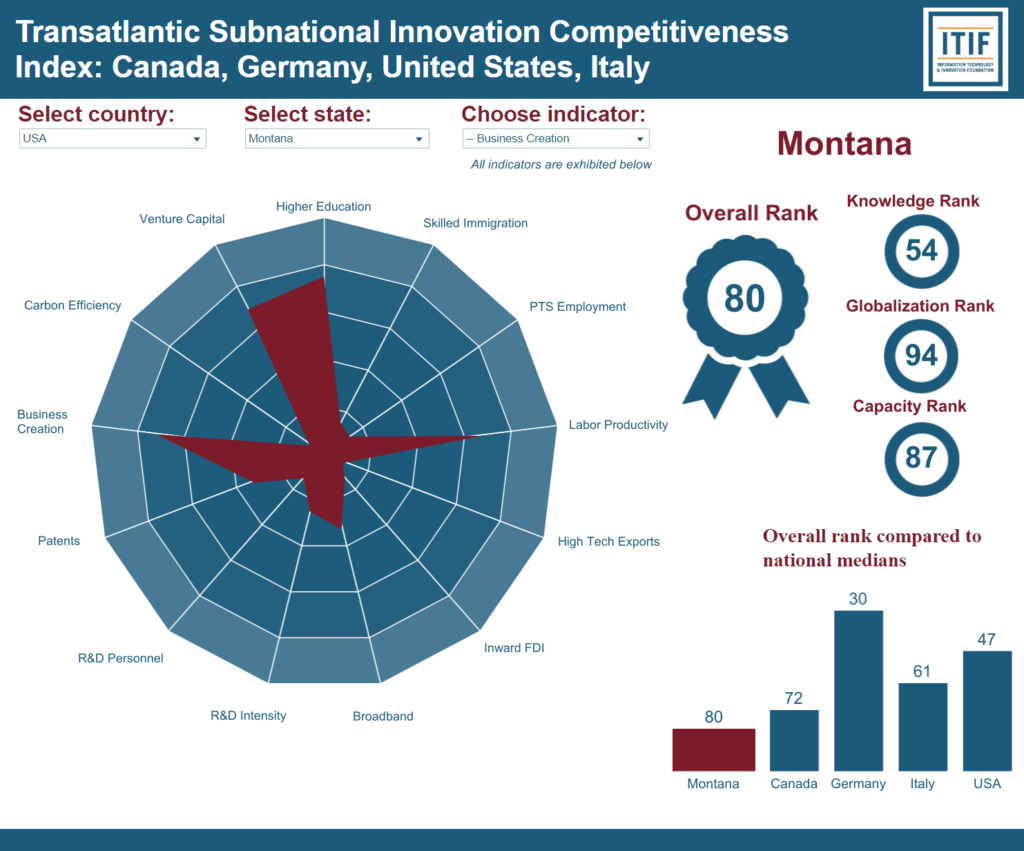

Graphic of the Week